XRP Price Prediction: Assessing the Path to Recovery Amid Consolidation

#XRP

- Consolidation Phase: XRP is trading below its key 20-day moving average and in the lower half of its Bollinger Bands, indicating a pause in trend and a period of price digestion.

- Mixed Sentiment Drivers: Long-term bullish factors like institutional ETF demand and Ripple's regulatory-approved expansion are offset by near-term caution, seen in declining futures interest and some tempered price projections for 2026.

- Range-Bound Outlook: The immediate path is likely constrained between support at ~$1.93 (lower Bollinger Band) and resistance at ~$2.35 (upper Bollinger Band), with a break above the 20-day MA at $2.1448 needed to signal a stronger recovery.

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Below Key Moving Average

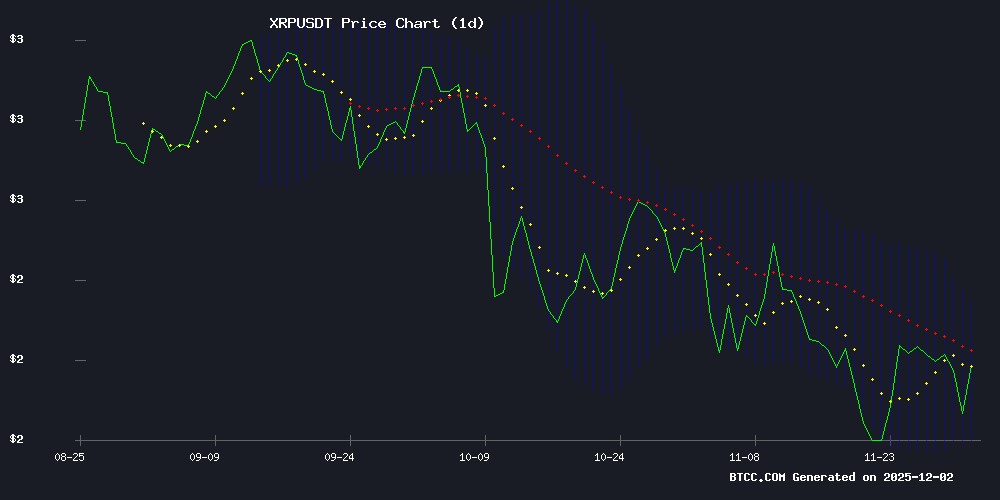

As of December 2, 2025, XRP is trading at $2.0172, below its 20-day moving average of $2.1448. This positioning suggests the asset is in a short-term corrective phase relative to its recent trend. The MACD indicator, with a value of -0.0179, signals weakening bullish momentum as the MACD line sits below the signal line. However, the histogram is negative but not deeply so, indicating the bearish pressure is not yet severe.

The price is currently trading between the middle ($2.1448) and lower ($1.9348) Bollinger Bands. This placement within the lower half of the band, coupled with the price being below the moving average, points to a period of consolidation or mild bearish pressure. The immediate support to watch is the lower Bollinger Band at $1.9348, while a MOVE above the 20-day MA could signal a return to a more bullish structure.

"The technical picture for XRP suggests a pause in the recent trend," says BTCC financial analyst Olivia. "The key will be whether it holds above the $1.93 support. A bounce from there, confirmed by a MACD crossover back into positive territory, could set the stage for a retest of the $2.35 upper band."

Market Sentiment: Bullish Catalysts Face Near-Term Headwinds

Current news FLOW presents a mixed but fundamentally supportive backdrop for XRP. Bullish drivers include sustained institutional demand, potentially linked to ETF speculation, and Ripple's strategic expansion in key markets like Singapore with regulatory approval from the Monetary Authority of Singapore (MAS). This reinforces XRP's utility in cross-border payments.

However, these long-term positives are tempered by near-term caution. A sharp decline in futures open interest suggests traders are reducing Leveraged positions amid market consolidation, indicating a wait-and-see approach. Furthermore, some analyst projections point to limited upside potential for 2026, with attention shifting to emerging competitors like Remittix.

"The narrative is one of strong foundations meeting short-term uncertainty," notes BTCC financial analyst Olivia. "Institutional accumulation and real-world adoption are powerful, slow-burn fuels. But the market is currently digesting recent moves, which aligns with the technical consolidation we are seeing. Sentiment is cautiously optimistic but not euphoric."

Factors Influencing XRP’s Price

XRP Price Recovery Fueled by ETF Demand and Institutional Accumulation

XRP has stabilized above $2 in early December, rebounding from November's volatility as ETF-related institutional demand injects liquidity into the market. Analysts note growing accumulation signals, with $660 million in net inflows to XRP-linked investment products—a trend amplified by Grayscale's new offerings.

The token faces a critical resistance level at $2.30, where supply dynamics clash with speculative trading. Market trackers report ETF activity is absorbing circulating supply, while short-term traders capitalize on pre-launch pullbacks.

Unlike meme coins or Layer 1 competitors, XRP's price action reflects a tug-of-war between regulated capital inflows and crypto-native speculation. Its ability to sustain momentum hinges on whether institutional demand can override retail sell pressure at key technical levels.

XRP Futures See Sharp Decline in Open Interest Amid Market Consolidation

XRP futures markets are experiencing a dramatic unwind, with open interest plunging 59% from 1.7 billion to 0.7 billion tokens. The drop coincides with a cooling of speculative fervor—funding rates collapsed from 0.01% to 0.001%, reflecting diminished leveraged trading activity.

The token currently trades at $2.05, with analysts eyeing a potential breakout above $2.15 toward resistance at $2.46. Glassnode data suggests this lull represents a structural pause, a consolidation phase preceding the next directional move.

Institutional interest, particularly from new ETF filings, adds a layer of cautious optimism. Yet the derivatives market tells a clearer story: leverage is being systematically purged, signaling a shift toward equilibrium after months of volatility.

XRP Price Prediction: Analysts See Limited 2026 Upside As Remittix Gains Momentum

XRP faces a crossroads as consolidation continues. Derivatives data reveals a 59% drop in futures open interest since early October, with leveraged traders retreating to preserve capital. Yet technical patterns suggest potential: a bullish flag formation and a break above the 23.6% Fibonacci retracement at $2.11 could pave the way for a move toward $2.46.

Meanwhile, Remittix emerges as a disruptor. Its PayFi ecosystem and live wallet are drawing comparisons to payment giants, with market participants dubbing it the 'next payment titan.' The project's real-world adoption potential contrasts sharply with XRP's stalled momentum.

Institutional interest in crypto remains selective. While ETF flows show early strength, the broader market hesitates. XRP’s failure to sustain November’s $3 breakout now leaves it testing support at $2.19—a level that must hold to prevent deeper losses.

Ripple Expands Payment Services in Singapore with MAS Approval

Ripple has secured an expanded scope of payment activities under its Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS). This approval enables Ripple Markets APAC Pte. Ltd., its Singapore subsidiary, to enhance regulated payment offerings and deliver faster cross-border solutions using digital payment tokens (DPTs).

Singapore's clear regulatory framework for digital assets has positioned it as a strategic hub for Ripple's growth in the Asia Pacific region. The company now joins a select group of blockchain-enabled institutions holding an MPI license, underscoring its commitment to compliance and transparency.

"Singapore has been at the forefront of fostering innovation while maintaining robust regulatory standards," said Monica Long, President of Ripple. The expansion reinforces Ripple's ability to provide end-to-end licensed payment services, cementing its role as a leader in blockchain-powered financial solutions.

How High Will XRP Price Go?

Based on the current technical setup and market sentiment, XRP's near-term price trajectory is likely constrained within a consolidation range, with a potential breakout dependent on key levels being breached.

The most immediate path is defined by Bollinger Band analysis. A sustained hold above the $1.9348 support (lower band) could lead to a retest of the 20-day Moving Average at $2.1448. A decisive break and close above this MA would be the first technical signal for a resumption of upward momentum, targeting the upper Bollinger Band at $2.3548.

For a more significant bullish move towards higher targets (e.g., $2.50+), we would need to see: 1) a bullish MACD crossover, 2) a sustained move above the $2.35 resistance, and 3) a resurgence in futures open interest alongside positive news flow. Conversely, a break below $1.93 could see a test of lower supports.

The following table summarizes the key technical levels and their implications:

| Level | Price (USDT) | Significance |

|---|---|---|

| Upper Bollinger Band | 2.3548 | Near-term resistance; breakout target. |

| 20-Day Moving Average | 2.1448 | Dynamic resistance/trend gauge. |

| Current Price | 2.0172 | Trading in lower half of range. |

| Lower Bollinger Band | 1.9348 | Critical near-term support. |

"Predicting a precise 'high' is challenging in a consolidating market," explains BTCC financial analyst Olivia. "The base case for the coming weeks is range-bound action between $1.93 and $2.35. The bullish scenario for a move toward $2.50 or higher requires the asset to reclaim its 20-day MA with conviction and for the positive fundamental drivers—like ETF momentum and Ripple's expansion—to outweigh the current cautious derivatives activity."